Latest Global VAT Specialist Group Newsletter looks at Brexit changes from January 2022

An importer bringing goods into Great Britain will no longer be able to delay making import customs declarations as was possible during 2021. Most GB importers will have to make declarations and pay relevant tariffs at the point of import.

VAT Specialist Group member Ian Marrow of Rickard Luckin sets out the current situation in the latest VAT Newsletter.

Ian explains

Helpfully, HM Revenue & Customs issued guidance which points out that one solution, Simplified Declarations, which takes 60 days to approve.

Exports between Great Britain and the EU will be subject to full customs controls. This means that goods must be presented to customs and the export declarations must be entered into HMRC systems to decide if any further physical checks are required.

All products of animal origin (POAO) and animal by products (ABP) imports into Great Britain will need to be pre-notified via the import of products, animals, feed and feed systems (IPAFFS). If not already, relevant businesses should look to register for IPAFFS as soon as possible. This pre-notification will also apply to procedures where Great Britain is used as a land bridge between two points within the EU, usually France to Ireland and vice versa.

Pre-notification must be “at least” 4 hours before the goods enter Great Britain. But it’s likely that this oddly timed period will change from 1 July 2022.

Hauliers should be registered for the Goods Vehicle Movement Service (GVMS) which should reduce the stops and checks made on goods moving from the EU to GB. They will also need to identify and record the precise export point from the EU to GB

Further changes in are due to take place in July 2022, and there will be a further update to enable businesses to prepare shortly.

View the full Global VAT Specialist Newsletter HERE

If you have any questions about the above or any other aspects of how Brexit may affect your business, please contact Ian Marrow at [email protected].

Watch the latest update from the Global VAT group

iframe allowfullscreen="" frameborder="0" height="500px" src="https://player.vimeo.com/video/670200638" width="100%">

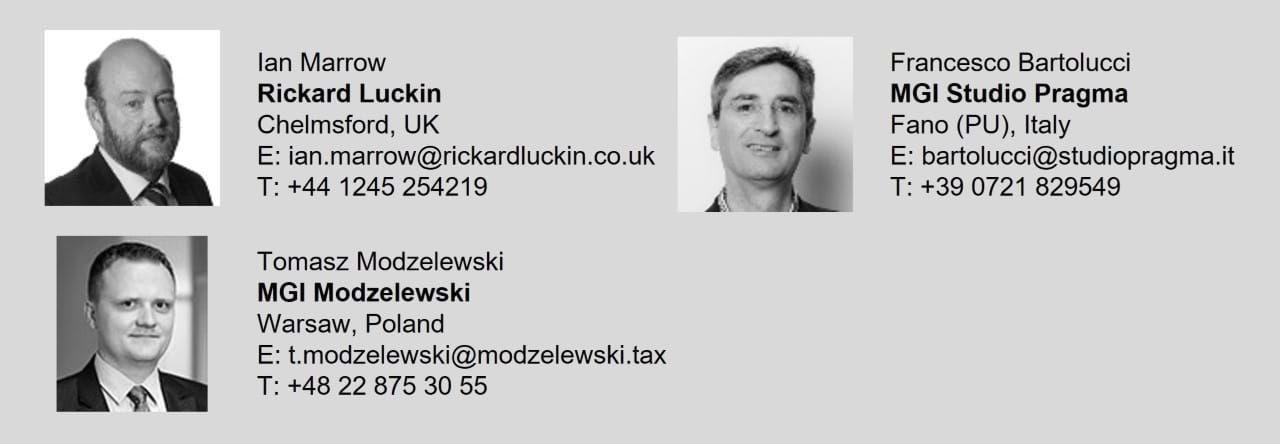

Our Global VAT Specialists

Our experienced VAT specialists provide a centre of excellence in the field of VAT & Customs across the world. Besides compliance questions, these experts can answer any day-to-day questions as well as assist you, among others, with the correct qualification of transactions, evaluations of contracts, VAT audits and setting up processes together with creating manuals and guidelines. Visit the microsite to meet the Global team.

To learn more about the activities of the Global VAT Specialist Group, or any of the other Groups, please contact International Business Development Manager, Nicki Lynn [email protected].

MGI Worldwide with CPAAI is a top 20 ranked global accounting network and association with over 9,000 independent auditors, accountants and tax experts in some 400 locations in over 100 countries around the world.