India's MOOWR scheme webinar on 10 March

The Government of India is making continuous efforts to promote the country as a global manufacturing hub and has made a commitment towards enabling ease of doing business.

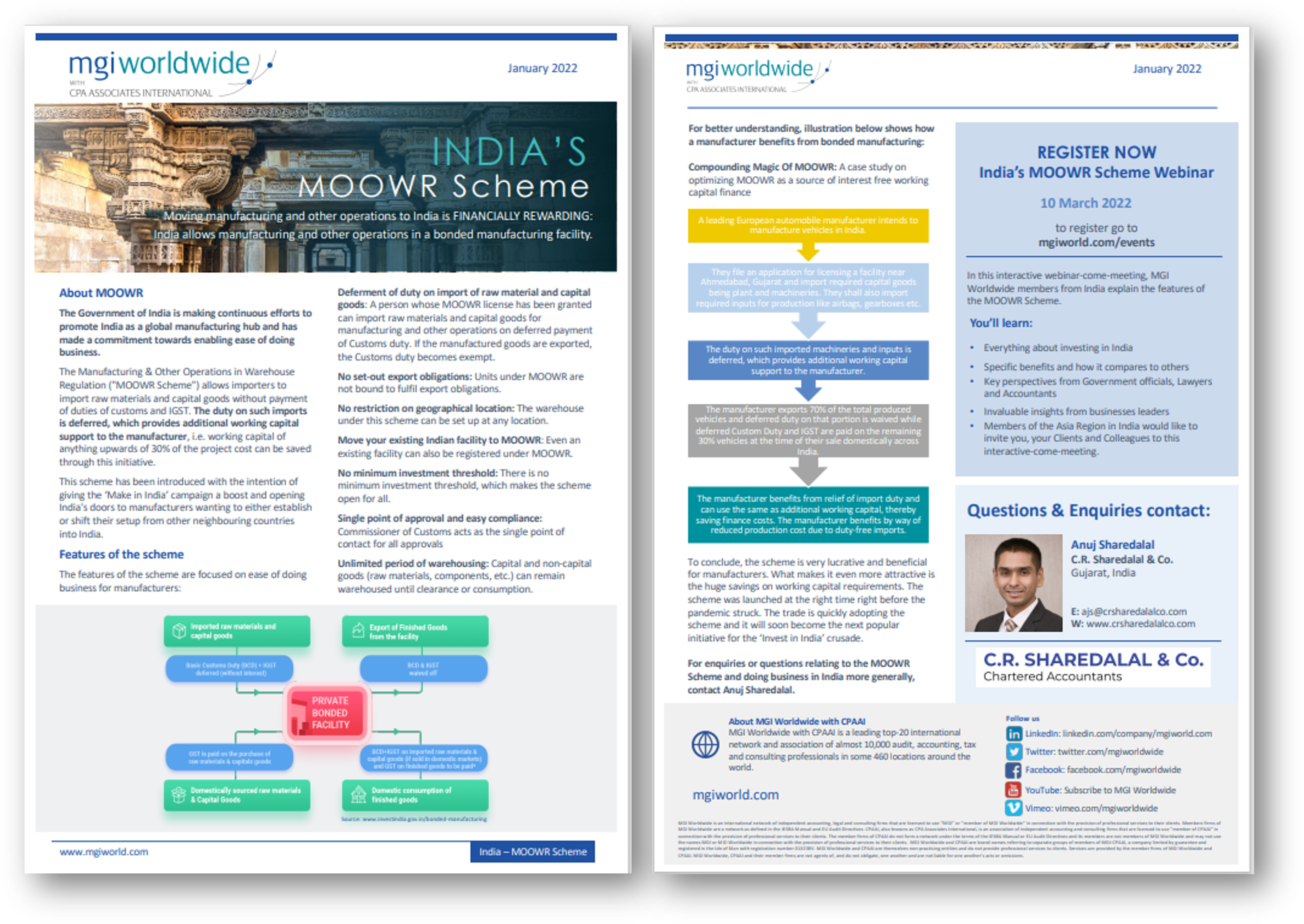

The Manufacturing & Other Operations in Warehouse Regulation Scheme (MOOWR) allows importers to import raw materials and capital goods without payment of duties of customs and IGST. The duty on such imports is deferred, which provides additional working capital support to the manufacturer, i.e. working capital of anything upwards of 30% of the project cost can be saved through this initiative.

This scheme has been introduced with the intention of giving the ‘Make in India’ campaign a boost and opening India's doors to manufacturers wanting to either establish or shift their setup from other neighbouring countries into India.

Features of the scheme

The features of the scheme are focused on ease of doing business for manufacturers:

Deferment of duty on import of raw material and capital goods: A person whose MOOWR license has been granted can import raw materials and capital goods for manufacturing and other operations on deferred payment of Customs duty. If the manufactured goods are exported, the Customs duty becomes exempt.

Deferment of duty on import of raw material and capital goods: A person whose MOOWR license has been granted can import raw materials and capital goods for manufacturing and other operations on deferred payment of Customs duty. If the manufactured goods are exported, the Customs duty becomes exempt.

No set-out export obligations: Units under MOOWR are not bound to fulfil export obligations.

No restriction on geographical location: The warehouse under this scheme can be set up at any location.

Move your existing Indian facility to MOOWR: Even an existing facility can also be registered under MOOWR.

No minimum investment threshold: There is no minimum investment threshold, which makes the scheme open for all.

Single point of approval and easy compliance: Commissioner of Customs acts as the single point of contact for all approvals.

Unlimited period of warehousing: Capital and non-capital goods (raw materials, components, etc.) can remain warehoused until clearance or consumption.

To conclude, the scheme is very lucrative and beneficial for manufacturers. What makes it even more attractive is the huge savings on working capital requirements. The scheme was launched at the right time right before the pandemic struck. The trade is quickly adopting the scheme and it will soon become the next popular initiative for the ‘Invest in India’ crusade.

Click to open/download the India's MOOWR Scheme PDF.

REGISTER NOW

Be sure to sign up for this interactive webinar-come-meeting, where MGI Worldwide members from India explain the features of the MOOWR Scheme.

India’s MOOWR Scheme Webinar

10 March 2022

to register go to

mgiworld.com/events

You’ll learn:

- Everything about investing in India

- Specific benefits and how it compares to others

- Key perspectives from Government officials, Lawyers and Accountants

- Invaluable insights from businesses leaders

- Members of the Asia Region in India would like to invite you, your Clients and Colleagues to this interactive-come-meeting.

|

|

For enquiries or questions relating to the MOOWR Scheme and doing business in India more generally, contact Anuj Sharedalal at [email protected].

MGI Worldwide with CPAAI, is a top 20 ranked global accounting network and association with almost 9,000 professionals, accountants and tax experts in some 400 locations in over 100 countries around the world.